EV prices are coming down: but how fast, and why?

Affordability is still a top concern when it comes to buying an electric vehicle (EV), a recent survey of NRMA members showed.

Out of 1376 members surveyed, 23 per cent of 376 members who are not sure about going electric said they’d feel more comfortable doing so if EVs were more affordable. This factor came in only second to choice: 28 per cent said they wished there were more EVs to choose from.

Meanwhile a new survey of 2004 vehicle owners from mycar Tyre & Auto found a third of drivers are considering an EV as the cost of fuel rises, to cash in on lower maintenance and running costs.

While EVs cost less to own over time, the upfront price still has many buyers hesitating. Though there are several affordable EVs under $40,000, are EV prices yet on par with ICE and hybrid cars? Let’s look at the market to find out.

Battery costs drop, price tracker shows EV prices falling faster than hybrids

One reason for falling EV prices is that the cost of making the most expensive part of the EV – the lithium-ion battery - is falling fast, due to ample lithium supply and a competitive market.

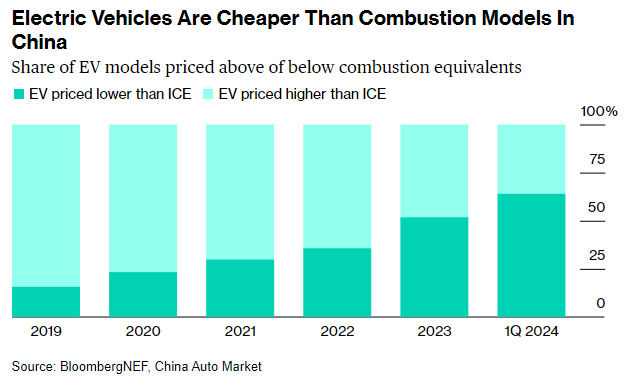

In China, a report by automotive industry analysis firm JATO shows that on average, Chinese EVs are already 19 per cent cheaper there than ICE vehicles.

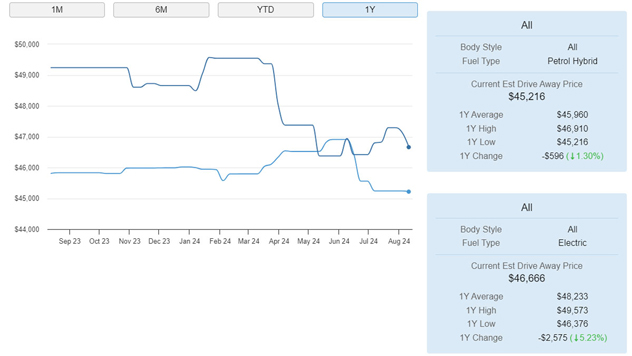

And these prices are starting to trickle to Australia. Vehicle price tracker The Beep shows that in the last 12 months, the average driveaway price of electric vehicles priced below $60,000 has dropped 5.23 per cent, to an average of $46,666.

Meanwhile, the average price of a petrol hybrid in the same price range dropped only 1.3 per cent, down to an average driveaway price of $45,216.

GWM recently dropped the price of the Ora electric hatch to just $35,990 driveaway, on par with the Corolla Ascent Sport hatch hybrid, which in NSW is priced at $35,868 driveaway.

— Bridie Schmidt

Price parity is already here (but it depends on what you buy)

There are already some EVs that you can buy locally for the same price as a hybrid – and say goodbye to fuel costs at the same time.

The devil is in the detail of course – and there are still electricity costs, but it is typically cheaper to charge an EV than to fuel an ICE or hybrid car. Also, recent EV price drops have played a large factor in reaching this unprecedented moment.

GWM Ora electrical hatch vs Toyota Corolla Ascent Sport hybrid hatch

Take for instance, the Great Wall Motor (GWM) Ora electric hatch compared against the Toyota Corolla Ascent Sport hybrid hatch.

GWM recently dropped the price of the Standard Range Ora electric hatch by $4000 to just $35,990 driveaway nationwide. This brings its price on par with the Corolla Ascent Sport hatch hybrid, which in NSW is priced at $35,868 driveaway – just $132 less.

Specifications

Weighing in at 1540kg and 1400kg respectively, the Corolla is 14cm longer than the 4235mm Ora but has slightly more luggage space (228 litres to the Corolla’s 217 litres with the seats up).

Features

Both have LED headlamps, heated and foldable door mirrors on the outside, and neither has a panoramic sunroof. Inside, both offer power-adjustable front seats, and power windows, plus 60:40 rear split seats with a folding centre armrest. Both also offer smart/keyless entry and automatic air conditioning, making getting into each vehicle a more seamless and comfortable experience.

Technology

In terms of connectivity, both offer USB input and while the Ora does not offer Android Auto alongside Apple CarPlay as the Corolla Ascent Sport does, it has larger touchscreens and instrument cluster screen (10.25” compared to the 7” and 8” displays in the Toyota.)

Both also offer 6-speaker sound systems, and while the Standard Range Ora doesn’t offer digital radio like the Ascent Sport Corolla, it has a wireless phone charger.

Performance

There are also some fundamental differences due to their differing powertrains.

The hybrid is powered by a 1.8L 4-cylinder VVT-i engine power paired with Toyota’s hybrid system that together offer 103kW power and 142Nm torque. Of course, the hybrid can drive a lot further on a single tank of petrol – almost 1000km depending on driving conditions.

By comparison, the Standard Range Ora drives 310km based on WLTP tests – about 280km in combined highway/city driving.

But the Ora, being electric, is powered by a 48kWh lithium-Ion battery and has more oomph than the Toyota, delivering 126kW motor and 250Nm torque.

It also has electric-only features such as a one-pedal driving experience, regenerative braking, plus servicing at nearly half the cost of the Toyota ($99 per service compared to $180 per service.)

Total cost of ownership comparison

We did some calculations using this example and found that over 10 years, the GWM Ora’s total cost of ownership (TCO) would save $4,000 if driven for the Australian average of 12,100km a year.

We’ve used the latest Sydney average fuel price from NRMA’s fuel report, and a 30c/kWh rate for electricity, even though it’s possible to pay as little as 8c/kWh on certain EV tariffs and plans. We’ve also used the same loan rate, although some banks offer a discount for EVs. See below for further assumptions.

|

Model |

Toyota Corolla |

GWM Ora |

|

Trim |

Ascent Sport |

SR |

|

Purchase price (NSW)* |

$35,868 |

$35,990 |

|

Average Service Costs/year |

$180 |

$99 |

|

Fuel Efficiency** |

4.2 |

15.4 |

|

Est fuel costs/year |

$905 |

$559 |

|

Rate |

6.49% |

6.49% |

|

Monthly Repayment |

$701.63 |

$704.02 |

|

Total interest |

$6,229.84 |

$6,251.03 |

|

Annual insurance*** |

$1,254 |

$1,261 |

|

Total insurance |

$6,270 |

$6,305 |

|

5 year TCO |

$53,791 |

$51,836 |

|

10 year TCO |

$65,484 |

$61,361 |

* All figures above are based on NSW pricing. ** For EVs, kWH/100km, for ICE, litres/100km. Fuel efficiency based for ICE based on Real World Testing by the AAA. Energy efficiency for EVs based on Real World Range from EV Database. Fuel costs are $1.78 per litre, and electricity costs are $0.30/kWh. *** Source: Redbook/Budget Direct. Based on assumptions including postcode 3133, a Rating 1, 40 year old male with no claims in the last 5 years and no younger driver listed. Car unfinanced and garaged at night.

While the choice to go hybrid or electric – and indeed, what model suits any person’s particular needs - is a personal choice, this comparison is one example of where an EV is already on par with a hybrid in simple terms of sticker price.

Battery manufacturing costs plummet

While some EVs are dropping in price fast, there is still a gap between some apples for apples comparisons. For example, the MG ZS compact SUV in the Excite trim is priced at $23,990 driveaway.

While the MG has dropped the starting price of its electric equivalent, the ZS EV, down to a record low of $34,990, it will take 12.25 years for ownership costs to equalise using our above assumptions. If only charging at an 8c/kWh rate, the TCO would equalise in seven years.

|

Model |

MG ZS |

MG ZS EV |

|

Trim |

Excite |

Excite |

|

Purchase price (NSW)* |

$23,990 |

$34,990 |

|

Average Service Costs/year |

$281 |

$221 |

|

Fuel Efficiency** |

7.7 |

16.1 |

|

Est fuel costs/year |

$1,845 |

$156 |

|

Rate |

6.49% |

5.79% |

|

Monthly Repayment |

$568.81 |

$818.38 |

|

Total interest |

$3,312.93 |

$4,292.07 |

|

Annual insurance*** |

$1,340 |

$1,416 |

|

Total insurance |

$10,050 |

$10,620 |

|

7 year TCO |

$53,299 |

$52,728 |

|

10 year TCO |

$48,565 |

$43,051 |

* All figures above are based on NSW pricing. ** For EVs, kWH/100km, for ICE, litres/100km. Fuel efficiency based for ICE based on Real World Testing by the AAA. Energy efficiency for EVs based on Real World Range from EV Database. Fuel costs are $1.78 per litre, and electricity costs are $0.08/kWh. *** Source: Redbook/Budget Direct. Based on assumptions including postcode 3133, a Rating 1, 40 year old male with no claims in the last 5 years and no younger driver listed. Car unfinanced and garaged at night.

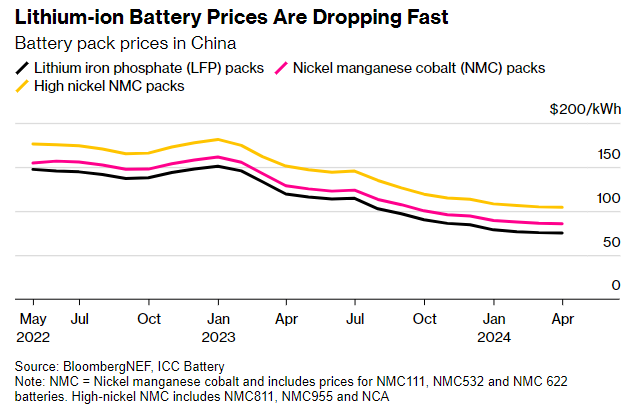

But with battery prices dropping, this gap will close in the coming years. A recent report by BloombergNEF has shown that the pack level price for batteries dropped below $US100/kWh ($A148/kWh) in October last year, down a whopping 90 per cent from $US1415/kWh ($A2147/kWh) in 2008 according to the US Goverment’s Department of Energy.

This figure has long been used as a benchmark for when EVs could reach price parity with ICE vehicles.

Since then, the pack price for lithium-iron phosphate batteries has fallen to $US75/kWh ($A110/kWh) in April, while high-energy density nickel battery packs hover just above this number at $US104/kWh ($A153/kWh.)

Why is this important? Lithium-iron phosphate (LFP) batteries power the entry-level Tesla Model 3 and Model Y, as well as BYD, GWM and MG electric cars – all models which are at the lower end of the price spectrum.

All these are vehicles made in China, from where a parade of new EV-focussed brands are preparing to expand into Australia. There, nearly two-thirds of available electric vehicle are cheaper than ICE equivalents – and more are coming, and set to launch in markets like Australia over the next two years.

Why are battery costs falling?

Part of the reason behind the drop in battery prices is that there is an oversupply of lithium-ion batteries: China alone made enough batteries to supply global demand in 20232.

Additionally, the price of raw materials to make batteries has fallen. The majority of the cost is in the cathode, which is where the lithium is used. Whereas the cathode used to amount to 50 per cent of the battery cell cost, it now accounts for just 30 per cent, says BloombergNEF.

The oversupply of batteries will mean further shakeups in the industry as tight margins push out poorly performing manufacturers, and this intense competition is behind the recent price drops. But the report states that further improvements in battery technology will also continue to keep prices down in the foreseeable future.

What it all means on a global scale is any slowdown in EV sales is likely to pick up pace again, as the lower battery prices are passed on to consumers.

Conclusion

Globally, key factors driving further EV price reductions include an ample supply of lithium-ion batteries, primarily from China, and the rapid expansion of affordable Chinese EV brands.

These factors have led to significant drops in battery costs, especially in the crucial cathode component, which is now cheaper due to falling raw material prices.

As Chinese manufacturers continue to dominate the market with lower-priced EVs, these trends are expected to keep pushing prices down, making EVs more competitive with internal combustion engine vehicles globally.

For Australia, it means that the lower prices of incoming Chinese EV brands over the next few years will give not only EVs from incumbent carmakers a run for their money, but hybrid and ICE cars also.