Australia has long been known as a global laggard in electric vehicle (EV) sales. In 2023, China, Europe (famously led by Norway) and the USA accounted for 95 per cent of the world’s EVs (including plug-in hybrids), and globally, one in five passenger vehicles sold was electric1.

By contrast, battery electric vehicle (BEV) sales in Australia last year accounted for less than one in ten new car sales (7.2 per cent to be exact), and the first six months of 2024 has seen that share rise only modestly, to 7.9 per cent.

A rise in "anti-EV" stories in the media - combined with a rising cost of living – has potentially contributed to a slowdown in EV sales, at the same time as the sellers of EVs start targeting customers less likely to make the leap to new technology.

This trend may see a reversal over the coming years, however, ushered in by the New Vehicle Efficiency Standard and other pro-EV policies, a new tech-savvy generation of drivers and an influx of cheaper electric vehicle brands.

Part of the reason Australians have held off buying EVs has been due to the lack of choice. Although the number of models available is expanding, it is still far off the broad range of choice available in markets like Norway and the UK.

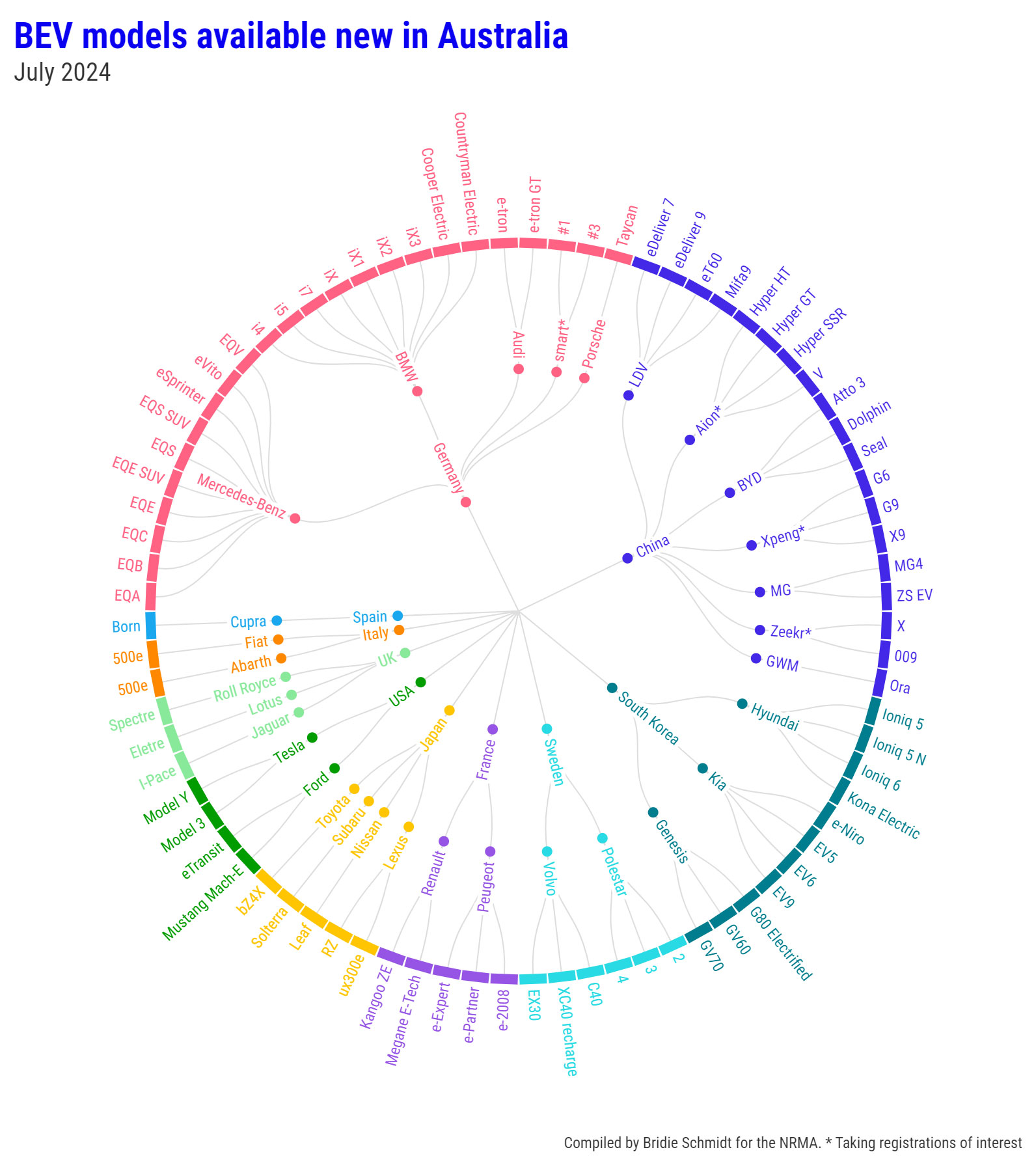

As of August 2024, there are 31 brands from nine countries selling or taking reservations for 80 pure battery electric vehicle models in Australia.

As the chart below shows, European carmakers have a strong foothold in Australia, at least in terms of choice of vehicles. German premium brands lead the way - Mercedes-Benz has 12 electric models for sale (including the smart #1 and #3 available via LSH Auto), while BMW is offering nine models including the all-electric Mini Cooper and Mini Countryman.

Three Volkswagen Group brands, Audi, Porsche, and Cupra, offer EVs, with Volkswagen soon launching the ID.4 and ID.5. French and Italian brands include Peugeot, Renault, and Fiat/Abarth, while Volvo and Polestar, owned by China’s Geely Holding, maintain Scandinavian roots, offering six models.

Asia boasts 11 brands, led by Hyundai Motor Group (Hyundai, Kia, Genesis) with 11 all-electric models. BYD and MG follow, with GWM's Ora as the most affordable EV. In the USA, Tesla dominates, with Ford offering the Mustang Mach-E and eTransit, and the F-150 Lightning available through AUSEV. Jeep plans to introduce the Avenger.

Japanese brands include the retiring Nissan Leaf, Toyota bZ4X, Subaru Solterra, and Lexus UX 300e and RZ. Mazda previously offered the MX-30. High-end luxury EVs from Jaguar, Lotus, and Rolls Royce are also available, are all manufactured in the UK (although owned by overseas interests – India's Tata Motors, Geely Holdings and BMW respectively.)

Meanwhile, China’s presence is growing daily. GWM and MG – now well known names to the Australia's drivers – have been joined by BYD, LDV. Most recently, Zeekr, Xpeng and Aion have started taking registrations of interest, bringing the count of Chinese models to 19 in total.

To see what EVs could potentially come to Australia, we can look to Norway. With three and a half decades of policy to encourage EVs under its belt, it has a mind-boggling 149 electric models from 38 brands from 11 countries currently available for sale2,3.

Norway differs from Australia in that it is a left-hand drive market, however. Some of these models may never be made in right-hand drive and will only be seen locally if imported under the Specialist and Enthusiasts (SEV) register.

What stands out though when comparing the two charts is the huge number of Chinese models in the Norwegian market – although this could be an anomaly in the not-too-distant future as Europe and the USA, the largest markets for EVs, dial down Chinese EVs with harsh tariffs.

The European Union (EU) has raised tariffs for Chinese-made EVs to a maximum 37.6 per cent on top of the existing 10 per cent duty4 in an effort to protect local auto manufacturing industries. The Guardian reports that Chinese carmakers claimed 11 per cent of the EU market in June as buyers rushed to purchase cheaper Chinese EVs before the tariffs were implemented in July.

This followed the USA which in May upped its tariffs on Chinese electric vehicles from 25 per cent to a whopping 100 per cent5, in a bid to protect legacy mainstays General Motors and Ford (which paradoxically are now delaying new electric models6,7.)

The UK – a key right-hand market in which many EVs destined for Australia are first introduced – said in past weeks it won't follow the lead of the European Union in introducing protectionist tariffs8. It has 128 BEV models available, including a growing Chinese-made market that includes 13 models.

Australia, unlike the USA and the EU, has removed import taxes for battery electric vehicles, hydrogen fuel cell electric vehicles, and plug-in hybrid electric vehicles priced below the luxury car tax (LCT) threshold for fuel-efficient cars under the Electric Car Discount Bill.

And with the price of electric vehicles tumbling, there are plenty of EVs available under the current LCT threshold of $89,332.

Though there are just a handful of Chinese EV brands confirmed for Australia so far, there are potentially far more that will eye our local market.

In China, the appetite for EVs is proving insatiable – and not for environmental reasons. The government’s strategy to dominate in the new market of electric vehicles as opposed to the already established ICE market has nurtured a highly competitive market that has resulted in almost 150 electric car brands9.

Numerous partnerships that China’s brands have forged with legacy European and Japanese carmakers have cemented the know-how to appeal to European-centric markets like Australia. Likewise, having secured battery supply chains, Chinese EV makers have focussed R&D on market-leading software and tech: like honey to the bee for the new Generation Z.

Numerous partnerships that China’s brands have forged with legacy European and Japanese carmakers have cemented the know-how to appeal to European-centric markets like Australia. Likewise, having secured battery supply chains, Chinese EV makers have focussed R&D on market-leading software and tech: like honey to the bee for the new Generation Z.

Without the “you can’t do that in an EV” culture wars that have taken hold in Australia fed by adversarial politics, Chinese buyers are not reluctant to take advantage of the “high quality and low price, not to mention dizzying variety” of electric cars available to them.

Coupled with the waiver of number plate lotteries for EVs in major cities, a third of the 26 million vehicles sold in China in 202310,11 were “new energy vehicles” - the regional term for pluggable electric vehicles which includes pure battery electric and plug-in hybrids.

The growing success of Chinese EVs is being attributed to heavy government subsidies by political leaders in the US and Europe, while JATO expert Felipe Munoz notes that the cheaper price of EVs in China – up to 19% less than ICE – can be attributed to the sheer volume of competition alone12,13.

In Australia where there is no local car manufacturing industry it is a win-win for local drivers. The four cheapest EVs in Australia are already Chinese – the GWM Ora, the BYD Dolphin and MG’s MG4 and ZS EV.

It’s still possible UK – which unlike Australia has an automotive manufacturing industry - may look to tariffs if it can be proved that subsidies are artificially deflating Chinese EV prices.

But here, a strong presence of people with Chinese ancestry is already influencing the market, such as in suburbs with higher densities of EVs like Ryde in Sydney.

Other urban areas – those with wealthier demographics, or outlying suburbs where it is thought that the greater distances to work (and therefore fuel dollars to be saved) and a guaranteed driveway to charge in – are also transitioning faster.

The increasing presence of EVs on roads in suburbs like these results in acceleration of EV uptake – known as the “neighbour effect” - as the familiarity of seeing more EVs on the road breaks down negative or cautious sentiment.

This, combined with a growing number of competitive Chinese manufacturers, policies such as the New Vehicle Efficiency Standard and a lack of protectionist tariffs, set the scene for a promising future where Australian consumers will enjoy an extensive selection of EVs tailored to diverse needs and preferences.

Despite the potentially positive outlook for rapid growth in EV choice locally, several challenges could impact the market's development. One concern is the over-reliance on Chinese brands, which may face obstacles such as geopolitical tensions and consumer preferences that could limit their appeal, despite competitive pricing.

While government incentives are important, other factors like widespread charging infrastructure, and consumer nous to charge regularly at home versus visiting “filling up” once a week at public chargers like a service station are crucial for consumer adoption.

The assumption that policy incentives and the absence of a local automotive industry will naturally lead to greater model diversity may overlook factors like Australia’s relatively small auto market.

Also in question is whether drivers will embrace EVs on a scale large enough to make expansion of more than a handful of new brands viable. Simply offering a wider range of models does not guarantee higher sales if the market isn't ready or willing to adopt the technology.

When all is said and done though, there is no doubt that in the absence of local competition, Australia has the potential to become a playing field for every major EV manufacturer with an ambition for expansion, becoming perhaps the broadest right-hand EV market globally. The only question is when?

References:

This article was updated on 14 August, 2024, to remove the BMW i3 and add the Polestar 3 and 4 to the models currently available new in Australia.